As the financial year draws to an end, there is still time to talk to your tax adviser about minimizing your tax bill for 2020/21. As a way of reminding you, we thought we would spend some time looking at who pays tax in Australia – and how much they earn before doing so!

The following has been drawn from the Australian Tax Office’s most recent data on tax collections for the 2018/2019 financial year. We hope you can find yourself among the high-rollers!

Who Pays the Most Tax?

This question is easy to answer: it is people like you and us! Individuals pay almost twice as much tax as companies and super funds combined, and they have been doing so for several years. Here is the breakdown between individuals, companies and super funds since 2014:

The spread of taxpayers was pretty even between men and women. 51% of tax returns were submitted by men; 49% by women. Men still earn more than women, with average taxable income of $73,218 compared to $51,382 for women.

How Much Tax do People Pay?

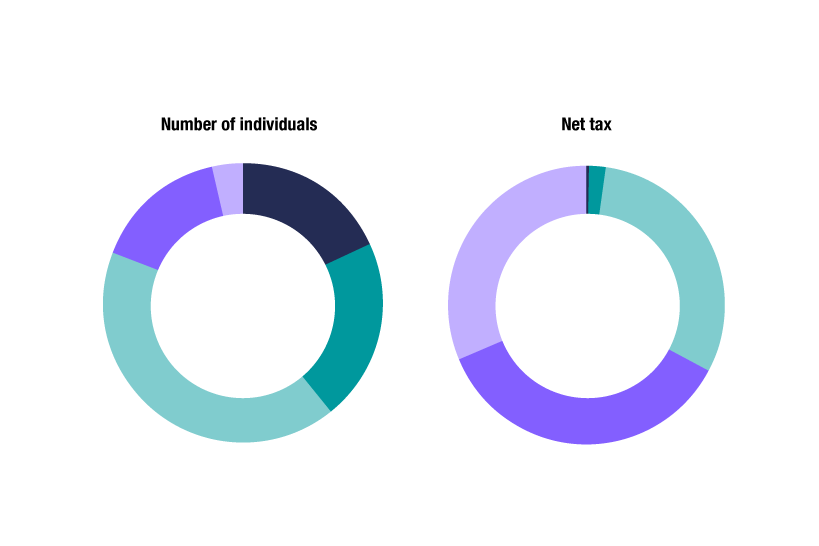

How much tax people pay is directly linked to how much they earn. For example, while more than 18% of taxpayers had taxable incomes below $18,200, that 18% of taxpayers contributed just 0.1% of the total tax paid. At the other end of the scale, while there were only 3.5% of taxpayers with a taxable income above $180,000, that 3.5% of taxpayers contributed 31.5% of all income tax receipts. Here is how the ATO present that information graphically:

Doctors were overwhelmingly Australia’s highest income earners. Surgeons made the most, closely followed by anaesthetists, so sending people to sleep pays almost as well as operating on them once they get there. Perhaps surprisingly, psychiatrists were the fifth highest paid occupation category in the country. Even more interestingly, of the top 10 income earning professions, psychiatry was also the smallest with only slightly more than 3000 psychiatrists lodging tax returns.

Where do Taxpayers Live?

The spread of income tax paid in various parts of the country is very similar to the spread of population around the country. Residents of New South Wales pay the most tax, which makes sense given that NSW is the most populous state. Residents of the Northern Territory pay the least tax, again consistent with the fact that the Northern Territory is the least populated state or territory in the country. In fact, people living overseas pay more tax in total than people who live in the territory:

NSW also dominates in the ‘wealthiest postcode’ stakes. As measured by taxable income, Australia’s wealthiest postcode was in New South Wales, as were four of the five wealthiest postcodes and seven of the 10 wealthiest postcodes. Only three non-NSW postcodes – two from Victoria and one from Western Australia – made the list of the top 10: