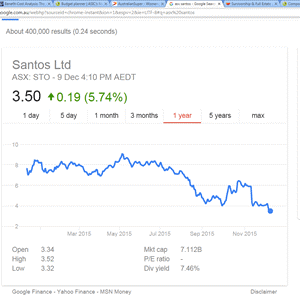

One of the key risks in markets like the share market is timing risk. Prices at which equities are bought and sold change regularly, as any glance at the 52-week high and 52-week low columns in share tables will attest. Have a look at the share prices for Santos over the 12 months of 2015 (thanks, Google):

As can be seen, the price of the same asset – in this case a share in a particular company – fluctuates widely over a relatively short period of time. Because of this fluctuation, investors who buy into volatile markets such as the share market run the risk of making their investment at a price higher than could have been achieved had they made their purchase at some other point of time.

The simplest way to manage this risk is to use a buying technique called dollar cost averaging. Dollar cost averaging is where an investor buys several smaller parcels of investment assets at several different points in time. This is as an alternative to buying a complete parcel of investment assets at a single point in time.

For example, rather than buy $60,000 worth of shares at a single point in time, an investor might prefer to buy $5,000 worth of shares at twelve monthly intervals during a year. There will be times when the price of the share is high, and $5,000 will buy relatively few shares. There will be times when the price of the share is lower, and $5,000 will buy relatively more shares.

Over the entire purchasing period, this means that a greater proportion of the overall assets will have been bought at lower prices. This drags the average purchase price of the portfolio down – hence the term, dollar cost averaging.

Of course, you don’t have to take our word that dollar cost averaging is a good high. If you follow Warren Buffett, or if you follow Lebron James, you will see that they agree with us. Which we think is kind of cool.